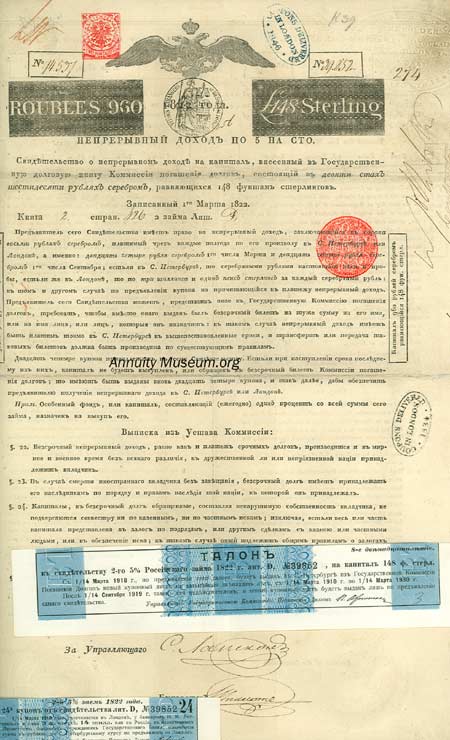

Russian Annuity Bond signed by N.M. Rothschild. FIVE per Cent. ANNUITY. No 94537. ANNO 1822. No. 39852. Certificate of a perpetual Annuity in the Great Book of the Public Debt of the Imperial Commission of the Sinking Fund, representing a Capital of Nine Hundred and Sixty Silver Roubles, equal to L. stg. 148. Entered the 1st. March 1822. Book 2. Folio 426 2d. Series. Letter D. The bearer of this Certificate is entitled to an Annuity of Forty-eight Silver Roubles, payable half-yearly, at his option, in St.-Petersburg or London; namely, Twenty-four Silver Roubles on the first day of March, and Twenty-four Silver Roubles on the first day of September; if in St.-Petersburg, in Silver Roubles of the weight and standard now current; if in London, at the rate of three shillings and one penny sterling per Silver Rouble: in both instances, on presentation of the Dividend Warrants then due. The Bearer of this Certificate, on application to the Commission of the Sinking Fund, may cause it to be converted into an Inscription in the Great Book, in his own name, or that of any person or persons whom he shall designate; in which case the Dividends will he payable in St.-Petersburg only, at the periods above mentioned; and the transfer, or cession of such Inscription be made according to the existing Regulations. Twenty-four Dividend Warrants are hereunto attached; if, when the last becomes payable, the Capital has not been redeemed or inscribed in the Great Book, twenty-four similar Warrants will be issued, and so forward, and in such manner as to secure to the Holder of this Certificate the due payment of the Annuity in St.-Petersburg or London.

NB. A Special Fund of ONE per Cent, on the Amount of this Loan is appropriated for its redemption. Extract from the Regulations of the Commission. Chap. 2:

?. 22. The payment of the perpetual Annuity, as well as the payment of the outstanding Debts, will be effected in time of Peace, as well as in time of War, without distinction, whether the creditor belongs to a friendly or a hostile nation.

?. 23. If a Foreigner, proprietor of Inscriptions, dies intestate, the inscriptions shall pass to his heirs, in the order of succession established by the Laws of the Country of which he was a subject.

?. 24. The Capital placed in the Perpetual Debt being considered as an inviolable Property, sliall be exempt from sequestration, both for claims of the Crown and those of individuals, unless these Capitals, in whole or in part have been given in security for Contracts of provisions, or by any other Articles of Agreement, whether with the Crown or with private individuals, or for the purpose of bailing any claim; in which case they are subject to the general Laws, concerning mortgages and bails. These Capitals are likewise exempted in all cases from every Tax.

?. 25- No Person can be constrained to take back the whole or a part of the Capital placed in tlie Perpetual Debt. But to facilitate to the Proprietors of Inscriptions the means of converting them, when they desire it into ready money, the Commission will employ annually, for the purpose of repurchasing them, at the current price, a Capital of the Sinking Fund which shall be assigned beyond the Fund necessary for the Payment of the perpetual Interest.

Bond signed: "Nathan Rothschild" St. Petersburg, Russia. In Russian, printed in French and English on verso. Five percent annuity certificate for a loan issued in 1918 with an expiration date of March 1930. The bearer was entitled to an annuity of 36 silver roubles. A sinking fund is a special reserve account into which the issuer promises to deposit funds at regular intervals and use the cash that accumulates to redeem the bonds, giving bondholders extra protection against default. Also signed by the Director of the Commission on verso. Accompanied by an original talon printed in Russian and English. At the time this bond was signed, Alexander I (1777-1825) was Czar of Russia (1801-1825). During the reign of Alexander, who was known for alternately befriending and then fighting with Napol?on I, St. Petersburg became the social and artistic center of Europe. Nathan Mayer ROTHSCHILD (1777-1836), who created the bulk of his family's wealth with his bank, N.M. Rothschild, and his investments, was the third son of Mayer Rothschild, who had founded a money-lending business in Frankfurt and was the agent of the British government in subsidizing European sovereigns during the Napol?onic Wars. Nathan, who left for England in 1799, where he was a textile and general merchant before moving into finance, was one of the world's richest men when he died in 1836. Nathan's son Lionel was elected to Parliament but was not allowed to take his seat because he was Jewish. Lionel's son, Sir Nathan Mayer Rothschild, 1st Baron Rothschild, was the first Jew admitted to the House of Lords. His son, 2nd Baron Rothschild, received the Balfour Declaration in 1917.