Life Expectancy Calculator

Retirement planning would be so much easier if you only knew how much longer you had to live. That's what we call your "life expectancy." Absent the power to know the future, your next best option is to estimate your life expectancy using a standard life expectancy calculator or table. A life expectancy calculator will also help you make better decisions about annuities. Annuities offer you a tax-deferred way to save for retirement and then to guarantee income payments for as long as you expect to live. The following life expectancy calculator shows you the average number of additional years you can expect to live, based only on your age and gender.

Life Expectancy Graph for 40 Year Old Male

The dangers of underestimating your life expectancy

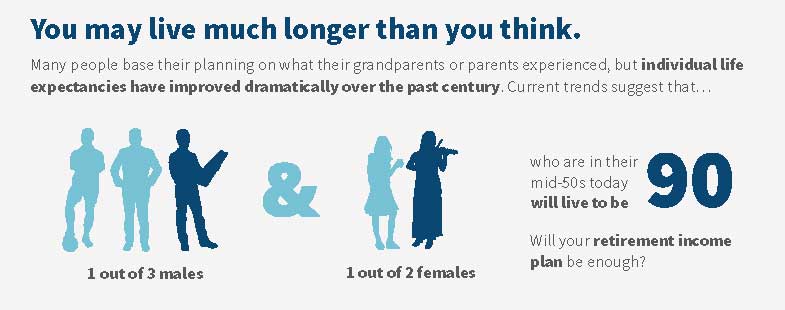

Recent studies by Michigan State University economics professor Todd Elder show that a significant number of Americans underestimate how long they are going to live.

Prof. Elder analyzed the answers of 58 to 61 year olds to the question "what chance do you have of living to age 75?" He then compared the respondents' predictions to their actual mortality data when enough time had passed to find out if they had guessed their life expectancies correctly.

Among his findings: More than half the respondents tended to underestimate their life expectancy!

For the group that believed they had zero chance of living to age 75, nearly 50% did. And 60% of those who thought they only had a 10% chance of reaching 75, actually lived that long.

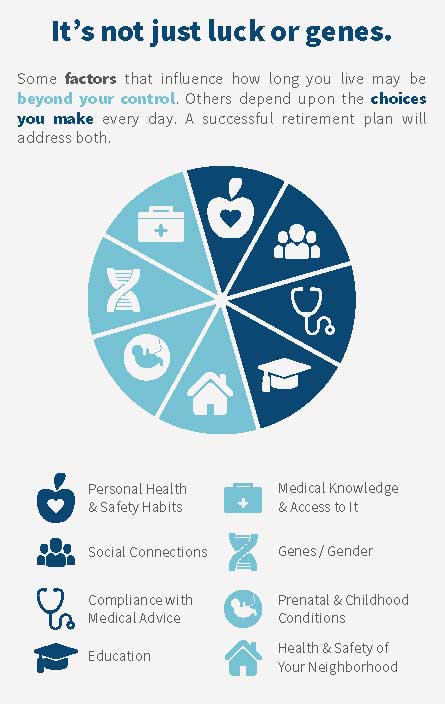

Not only do we tend to underestimate our life expectancy, but our actual life spans continue to increase each year with new breakthroughs in medicine and health care services. Plus, there always are some lucky people who defy the odds and live even longer than the statistics would suggest, so you need to plan for that possibility happening to you, too.

How annuities can help with the life expectancy conundrum

There are not many financial products that provide you with income that you can never outlive. Annuities are becoming increasingly popular because they provide this protection.

In the “good old days,” you could count on your company pensions to provide you with a lifetime income after you stopped working. But the U.S. economy has shifted away from those plans towards 401(k)s and individual retirement accounts which put a greater burden on you to save for your retirement and make sure your savings produce enough income to cover your needs when you are no longer working.

This is even more important because Social Security, which many people have viewed as the foundation of their retirement planning and a safety net, is often not enough.

What do the experts say about annuities?

Many experts say that annuities are a good solution for protecting against the risks of outliving your assets. A 2014 study by the Brookings Institution found strong arguments in favor of longevity annuities -– a type of deferred income annuity -- as an answer to the challenges posed by life expectancy uncertainty, the move away from pensions and other trends.

“We are optimistic that longevity annuities can significantly increase expected lifetime well-being for middle and upper-income retirees who have substantial financial assets at the time of retirement,” the authors wrote.

When analyzing if a longevity annuity is right for you, a good exercise is to compare the monthly annuity payment with what you could make by investing your money in an equally low risk portfolio. An assumption about your life expectancy is crucial to this analysis since the longer you live, the better deal an annuity becomes.

How your life expectancy determines annuity costs, benefits

The amount of monthly income you receive from an immediate or longevity annuity is determined in part by your life expectancy. For a quick reference the typical way that life expectancy and annuity terms interact are:

1. Single life annuities usually offer the highest monthly payouts, because the insurance company's risk is limited to your life expectancy.

2. Single life with refund payout offers you less income, because the insurer faces the obligation to continue paying your beneficiaries if you died before the premium had been paid to you.

3. 100% joint and survivor entails an even lower monthly payment but ensures your spouse gets the full annuity amount for his or her lifetime, too.

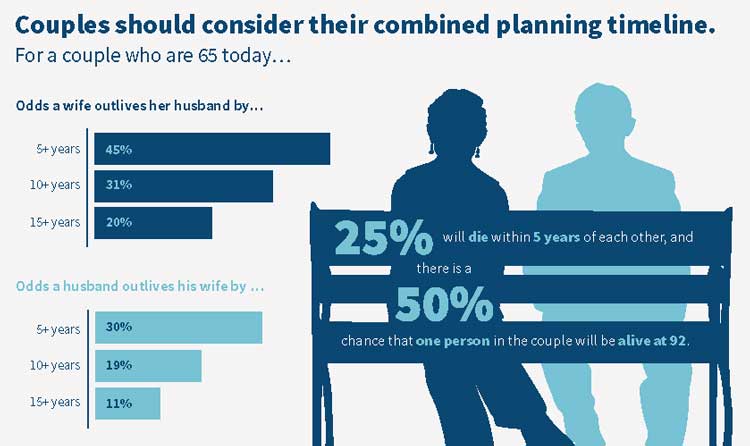

The cost of these policies is directly influenced by your life expectancy, since the insurance company must estimate how long it will be obligated to make payments to you. In an annuity contract with a joint life and survivor benefits, you and your spouse would continue to receive payments after one of you died. So in this case, both your life expectancies come into play in determining the annuity premium or monthly income.

Delaying the first payment

Another way in which life expectancy enters into the annuity equation is deciding how soon you should start taking income payments. With a longevity annuity, the longer you defer those payouts, the bigger they will be. This is because the insurer reduces the likely period of time it will have to keep making monthly payments to you.

As we have demonstrated, your life expectancy has major implications with annuities. To figure out your plan to protect against income uncertainties, start with our life expectancy calculator, then consult our buying guides to learn more about the different types of annuities.

Our instant annuity quote calculator can help you compare annuities side by side so you can identify the best annuity option for your needs and situation. However many years you have left to live, make them as comfortable and carefree as possible by figuring out your retirement income needs today!

We'd love to hear from you!

Please post your comment or question. It's completely safe – we never publish your email address.

Comments (8)

Hersh Stern (ImmediateAnnuities.com)

2019-09-16 10:28:22

I'm very happy to help you with this. Most of our companies will allow an immediate annuity for a 34 year old. However, I'd like to go over some of the specifics with you. For example, I'd like to figure out exactly what income option you're interested in. Since you are purchasing this annuity for your son, you might also be interested in making the annuity "non-assignable." This means that the annuity is impossible to sell or surrender in return for a lump sum.

When you have a few free minutes, please call my office at 800-872-6684 and someone here will be happy to assist you.

-Hersh

Arthur

2019-09-16 10:27:15

I want to purchase $700,000 fixed immediate type annuity for my 34 yo son who has schizophrenia.

Your recommendations?

Hersh Stern (ImmediateAnnuities.com)

2019-04-05 08:26:04

We have several annuities that could be suitable for someone in their 80s, depending on your goals. Would you like this annuity to provide you with guaranteed lifetime income, or are you looking for something similar to a certificate of deposit (that will grow by a fixed interest rate)?

I invite you to please call me on our toll-free number, (800) 872-6684. I'll be very happy to help in any way that I can.

-Hersh Stern

Grace

2019-04-05 08:25:04

Is there a good annuity for someone in their 80's?

Hersh Stern (ImmediateAnnuities.com)

2016-02-25 11:48:54

Hi Judy -

As far as waiting until your next b-day: Some companies will consider you to be 73 when you are within 6 months of July 24th. So that was on January 25 (4 days ago).

May I draw your attention to the quotation charts you received by email. You'll find a small numbered footnote following each insurance company name.

The legend for these footnotes is below the quotation table. I've copied the first three footnotes and explained each them here:

1: Age based on your nearest birthday. These companies consider you to be a year older when you are nearer to your next b-day, which already happened a few days ago. So you'll income from these companies will not increase as you get closer to or pass your next birthday. In fact, if you're right about interest rates dropping, waiting will reduce your payout from these companies.

2: Age based on your last birthday. These companies consider you to be a year older only after you reach your next birthday (on July 24). So you'll income from these companies will not increase until then.

3: Age interpolated to the nearest day. These companies interpolate your age every day. They don't bump up your age when you enter the period that is 6 months closer to your next b-day, nor do they change your payment just because you reached your next b-day (on July 24th). Each day, as you are older, your income is proportionally increased a tiny fraction.

Hersh

Judy

2016-02-25 11:38:47

Your site is most helpful. I turn 73 on July 24th, so I was playing with the calculator to see what I might get at age 72 and 73. The payment went up from $590 to $599. Not sure whether to wait until I turn 73 or not. Interest rates seem to be going down, not up. Such uncertainty these days.

Hersh Stern (ImmediateAnnuities.com)

2016-02-25 11:35:44

Hi CV-

I looked up your quote request and I see that you are considering a Period Certain annuity. With a period certain annuity your age does not affect the income. Whether you are 40, 60, or 80 years old, the quotes are the same for a period certain annuity.

Hersh

CV

2016-02-25 11:35:11

If I am a year older will I get more money?